Governance Structure

Maximization of Unitholder Value through the Construction of a Proper Governance Structure

System of Investment Trust Management Fees at the Asset Manager

Canadian Solar Infrastructure Fund, Inc. (the “Investment Corporation”) adopts investment trust management fees linked with revenues from the leasing business in connection with the assets under management in the business period concerned (“Investment Trust Management Fees I”) and investment trust management fees linked with the sum of net income for the business period concerned and fixed adjustments (“Investment Trust Management Fees II”). By integrating these investment trust management fees, the Investment Corporation intends to give Canadian Asset Solar Management K.K. (the “Asset Manager”) an incentive to increase both the revenues from the leasing business and net income. By taking this measure, the Investment Corporation seeks to ensure that the profits of unitholders agree with the profits of the Asset Manager.

| Investment Trust Management Fees I | The amount of rents that arise from assets under management, incidental revenues, damages, penalties for the cancellation of lease contracts, money similar to such penalties and revenues from other types of leasing businesses x 6.0% (upper limit) |

|---|---|

| Investment Trust Management Fees II | The sum of Investment Trust Management Fees II, net income before the deduction of the consumption tax and the like on Investment Trust Management Fees II unqualified for deduction, and depreciation and amortization x 6.0% (upper limit) |

| Acquisition fees | Acquisition value x 2.0% (upper limit) Acquisition value x 1.0% (upper limit) in cases where the other party is a group of sponsors |

| Transfer fees | Transfer value x 2.0% (upper limit) Transfer value x 1.0% (upper limit) in cases where the other party is a group of sponsors |

| Merger fees | The appraisal value of the underlying assets which meant renewable power generation facilities and/or Real Estate related assets held by the subject investment corporation as of the effective date of the merger x 1.0% (upper limit) |

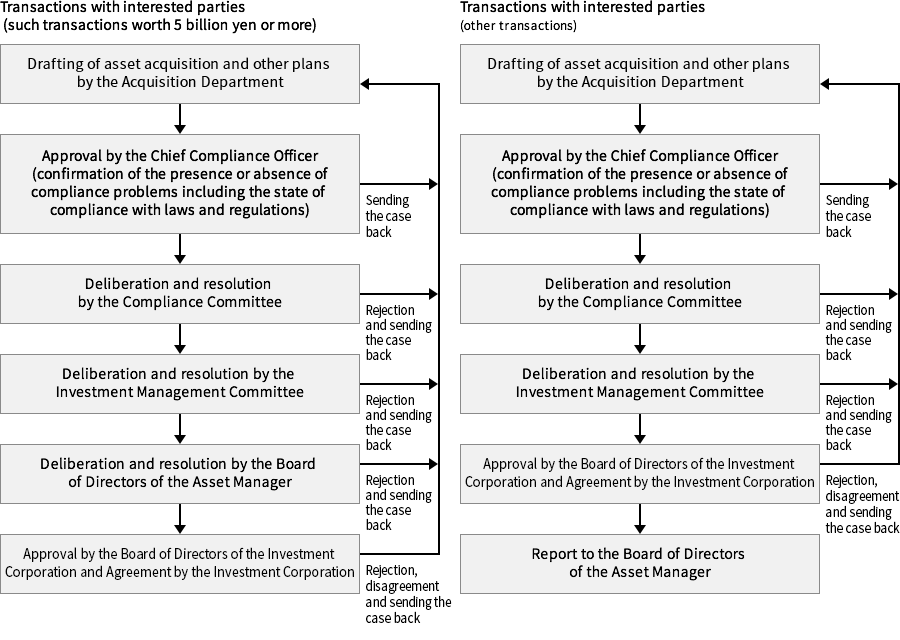

Countermeasures for Conflicts of Interest and Adoption of a Management System in Which Objectivity Is Guaranteed

The Asset Manager has laid down measures for preventing harmful influences in the Regulations for Interested Party Transactions in connection with transactions and the like with interested parties such as Canadian Solar Group companies with which conflicts of interest are highly likely to emerge.

Decision-Making Structure Concerning Transactions with Interested Parties Related to Asset Acquisitions and Transfers