Responsible Investment Approach

CISF stipulates the following approach in the two stages of infrastructure investment and operation.

Guidelines on Investment in Renewable Energy Power Generation Facilities

●Investment in clean energy

Solar power plants and other power plants in which CSIF can invest in (hereinafter collectively referred to as “Renewable Energy Power Generation Facilities”) shall contribute to (1) reducing CO2 emissions and (2) mitigating environmental destruction, either directly or indirectly, and clean energy power stations with no resource waste and a high probability of improving the environment.

●Identifying business risks when acquiring renewable energy power generation facilities

At the time of acquisition of renewable energy power generation facilities, its negative impact on the environmental and social aspects shall be checked by in-housel departments with expertise by obtaining a soil contamination report, structural integrity report and technical due diligence report produced by a third party. Where the subject facilities have a risk, it shall be judged that a countermeasure is taken and that the negative impact is unlikely to exceed environmental improvement effects.

●Establishing the SRI selection process

Eligibility criteria and the selection process of green projects shall be established. In the due diligence of new investment projects implemented by CSIF, it shall be judged that the renewable energy power generation facilities will (1) not damage the health of people in the neighborhood or negatively impact the local municipality, and (2) not involve in forced labor in the supply chain and in the development. At the same time, risks shall be identified by the Investment Management Department of CSAM as Asset Manager. Where a negative environmental impact has been identified, countermeasures shall be taken by applying knowledge of internal and external specialists to eliminate factors causing the impact. In addition, where solar power generation facilities or the similar facilities are to be acquired from a related party, the acquisition shall be deliberated and resolved by CSAM’s Compliance Committee in advance.

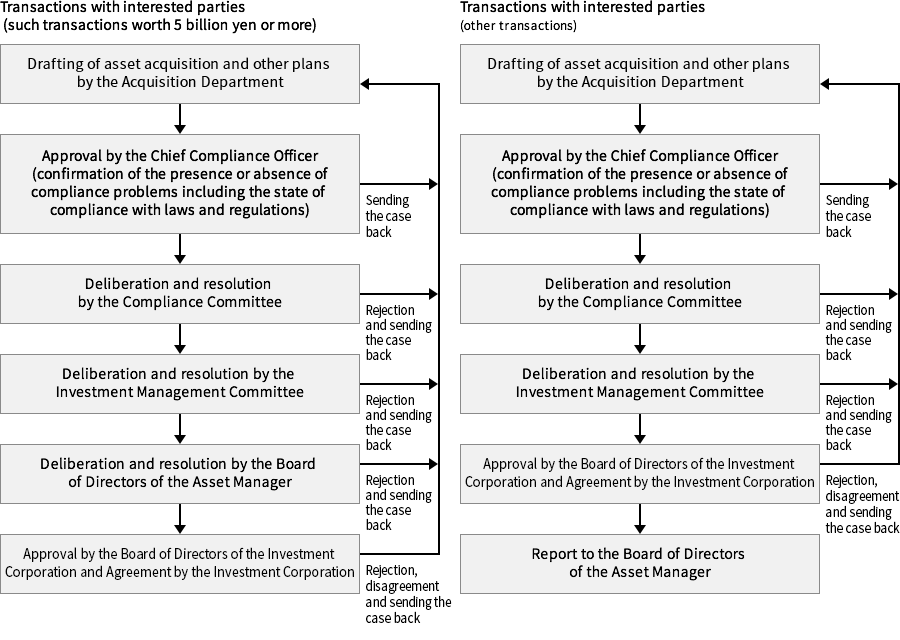

Decision-Making Structure Concerning Transactions with Interested Parties Related to Asset Acquisitions and Transfers

●Implementation of Green Financing

When funds are procured by borrowing, it shall be clarified that our fund will be used for a “Green” purpose, so financial institutions such as banks that are sympathetic to the environmental-friendly business model of CSIF will be motivated to supply debt financing.

Transparency of Management and Operations by CSIF

●Validity and transparency of management of borrowed funds

The full amount of funds procured by borrowing is linked to individual projects that are selected in advance, and management including monitoring of the account is carried out by the Financial Planning Department of CSAM. At the time of withdrawal, an approval is given by the Chief Financial Officer and the Representative Director before instructions to withdraw the money are issued. The account activity procedures are subject to internal audits by an internal organization and external audits by an auditing organization. The procured funds are managed as cash or cash equivalent, and the planned date of disbursement, etc. shall be disclosed to our lenders as necessary.

●Appropriate reporting structure

i With regard to reporting of the disbursement status of funds, content deemed necessary by CSIF shall be disclosed to investors at CSIF’s website on a regular basis. With regard to borrowings, the procured funds shall be applied to appropriate projects, and clear rules on reimbursement shall be established with the financial institution from which the money is borrowed. The rules shall also be disclosed on a timely basis on CSIF’s website and other media, and to investors via financial presentation materials and asset management reports.

ii With regard to reporting related to environmental improvement effects, information showing these effects is disclosed monthly on the website by including the output of solar power plants owned by the CSIF and the amount of reduction of CO2 emissions as quantitative indexes.

●Structure for audits during the fiscal year

i Accounting audits

Accounting data processing of CSIF is outsourced to EY Japan Tax. Its accounting book is closed every month for review. In addition, every fiscal year, CSIF receives an audit based on the Act on Investment Trusts and Investment Corporations and one based on the Financial Instruments and Exchange Act by a third-party accounting auditor. Thus, CSIF fulfills eligibility requirements for the Tokyo Stock Exchange Infrastructure Fund and has introduced a highly transparent accounting audit structure.

ii Operational audits

As the person in charge of internal audits, the Chief Compliance Officer conducts an internal audit every six months, in principle, in accordance with the internal audit regulations and creates an internal audit report, which accurately describes problems and other matters discovered and pointed out in the internal audit. The person in charge of internal audits submits the internal audit report to the Representative Director, the Board of Directors, and the Compliance Committee without delay. Audited departments consider the seriousness of their problems that were cited in the internal audit report, create an improvement plan without delay, and strive to make planned improvements. The person in charge of internal audits appropriately manages the status of improvements on problems at the audited departments, confirms they extent to which they have been made, and reflects this in future internal audit plans. The Board of Directors or the person in charge of internal audits has an external audit conducted by an external specialist for the purpose of confirming the appropriateness of business operation by the Asset Manager or where such an audit is deemed necessary for other purposes.

In addition to the above operational audits, the CSAM conducts monitoring of operators, O&M companies, and other outsourcing service providers once a year, in principle, to supervise the status of their execution of outsourced operations.

Sustainable Asset Management Business Model

●Employee training

CSI University’s curriculum supports each learner’s mastery of the various components of Canadian Solar’s business with the goal of maximizing the knowledge and understanding of our organization. The courses offer directly support’s Canadian Solar’s “MISSION” of leading solar into every household and creating a better and cleaner Earth for future generations, and “VISION” of becoming a global solar solution expert while creating a bright future with our partners, with a strong focus on our “VALUES” of Innovation, Integrity, Efficiency, Teamwork, and Entrepreneurship. CSI University is available online to its employees all over the world. This program provides opportunities to acquire practical knowledge and study cases about development and disposal of power plants, storage battery technologies, EPC, asset management of power plants, and other topics. In addition, CSAM holds internal study sessions regularly as a part of its employee training program by inviting specialists from a variety of companies related to infrastructure asset management and from the Canadian Solar Group.

●Creating a comfortable workplace environment

At CSI, women constitute 19% of top management team members. The Canadian Solar Group strives to practice management without prejudice based on gender, nationality, age, appearance, and other attributes, in its efforts to create a workplace environment that is free from discrimination. At CSAM, which has inherited the DNA of CSI, about half of all employees are women. In addition, based on the belief that human resources are its greatest assets, the Canadian Solar Group seeks to improve employee health, labor management, crisis management, and other aspects by conducting employee satisfaction surveys and stress checks. Thus, the Canadian Solar Group strives to improve the workplace so that it is comfortable for employees in this era of diversity.