Financial Strategy

Characteristics of Income and Expenditures for Businesses Including Photovoltaic Power Generation Facilities

Long-term, stable forecasts are possible for income and expenditures for businesses.

| ● | The CSIF thinks there is a certain limit to any decline in rent income because the procurement price and the procurement period for photovoltaic power generation facilities, in which the CSIF invests, have been established through a feed-in tariff (FIT) and the CSIF has a structure that guarantees basic rent from assets it acquires. |

|---|---|

| ● | The CSIF believes that long-term, stable forecasts are possible for income and expenditures for businesses because fixed expenses account for a large proportion of expense items. |

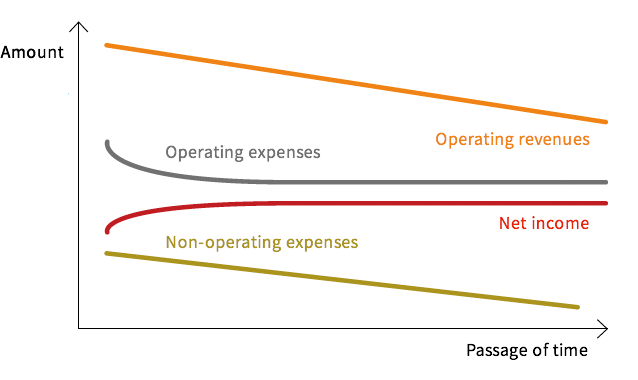

| ● | Specifically, changes in operating revenues, operating expenses and non-operating expenses for the CSIF during the term set for the FIT have the general characteristics stated below according to calculations based on certain assumptions in cases where the assets of the CSIF are assumed to have been acquired temporarily and additional asset capitalization and sales are assumed to have been avoided. The CSIF believes that its net income shows a tendency to rise gradually over the medium and long terms throughout the FIT term as a result (Note 1). |

| • | Operating revenues will decrease gradually over the medium and long terms on the assumption that the forecast volume of power reflecting a fixed panel deterioration rate (P50) is generated (Note 2). |

|---|---|

| • | Operating expenses focused on depreciable assets taxes paid (assuming a declaration based on the declining balance method) will decrease gradually in the medium and long terms (on the assumption of a fixed amount of rental business expenses, including repair expenses other than depreciable assets taxes paid, and expenses for maintaining and managing the CSIF (Note 3) ). |

| • | Non-operating expenses will decrease gradually over the medium and long terms, reflecting a decline in interest paid in step with a fall in the balance of loans attributable to installment principal repayments in cases where principal repayments for loans made by the CSIF (scheduled repayments) are performed during the period and interest rates are fixed to a certain extent (Note 4) ). |

A conceptual drawing for the characteristics of income and expenditures for the photovoltaic power generation facilities business during the FIT term

| (Note 1) | Tendencies according to calculations are stated on the assumption of changes in operating revenues, operating expenses and non-operating expenses accompanying the passage of time, which are estimated on the basis of certain assumptions and figures. These tendencies do not guarantee or promise that certain facts assumed will actually occur. Changes in actual net income for the CSIF may differ materially from the tendencies stated above in cases where relevant facts diverge from the assumptions. |

|---|---|

| (Note 2) | The tendency does not guarantee or promise that the volume of power actually generated will be the forecast volume of power generated (P50). Operating revenues may fall below the estimate in cases where the volume of power actually generated falls below the forecast volume of power generated. Operating revenues may also fall below the estimate in cases where the deterioration of panels advances at a pace quicker than assumed. |

| (Note 3) | The need to perform large-scale repairs during a specific business period arises in cases such as those where natural disasters and the like caused damage to photovoltaic power generation facilities and those where the deterioration of photovoltaic power generation facilities advances at a pace quicker than assumed. Such repairs may cause operating expenses to increase. |

| (Note 4) | The tendency does not guarantee or promise principal repayments during the period (scheduled repayments) or the fixation of interest rates. Interest expenses may increase and cause non-operating expenses to increase in cases where the repayments and the fixation do not take place. |

Growth Strategy Emphasizing Reinvestment from the Amount Corresponding to Depreciation and Amortization

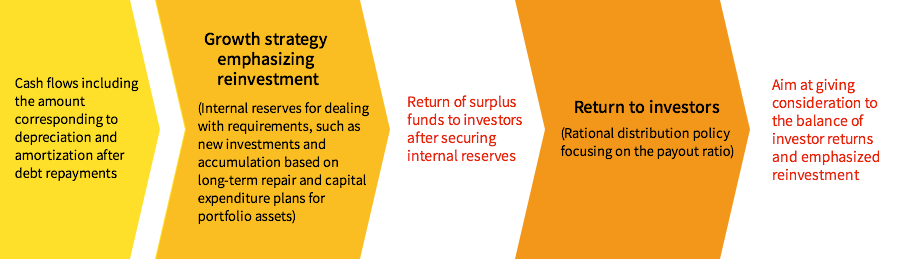

Growth strategy emphasizing reinvestment through the application of the amount corresponding to depreciation and amortization

| ● | The CSIF believes that the difference between income and cash flows in the account books will increase because the majority of renewable power generation facilities and the like it considers as investment targets are depreciable assets. |

|---|---|

| ● | The CSIF internally reserves cash flows including the amount corresponding to depreciation and amortization after the repayment of its debts within a scope assumed reasonable for dealing with reinvestments (including new investments based on plans for acquiring investment target assets and accumulation based on long-term repair and capital expenditure plans necessary for maintaining and improving the value of portfolio assets) for the purpose of maximizing the efficiency of surplus funds that arise from the difference. Basically, the CSIF aims to return surplus funds to investors after securing internal reserves. |

Steadfast Financial Strategies

Basic policy

The CSIF maps out and executes its financial strategies in planned and flexible manners with the guarantee of stable revenues and the steady growth of working assets as the objectives.

| Equity strategies |

|

||||

|---|---|---|---|---|---|

| Debt strategies |

|