Our Approach to Sustainability Organization Overview/Business Overview

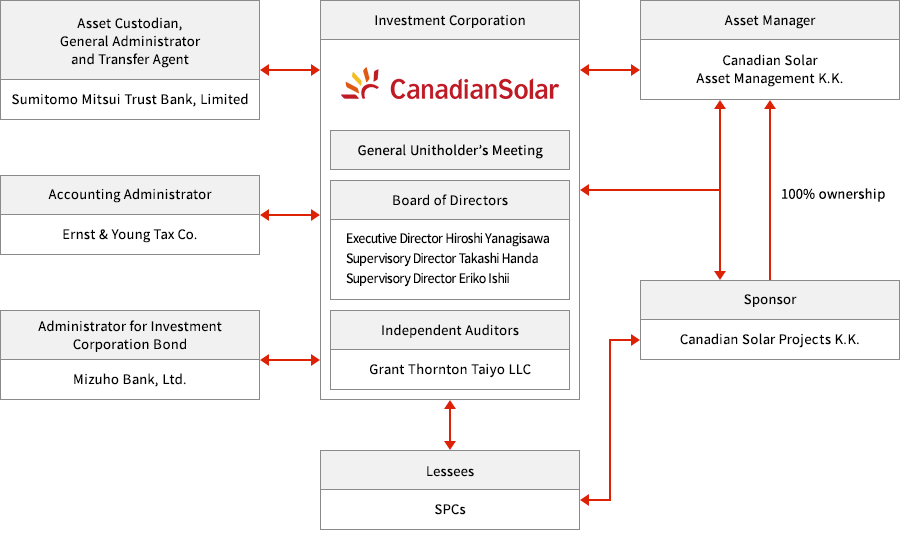

Overview of CSIF

| Name | Canadian Solar Infrastructure Fund, Inc. |

|---|---|

| Name of Representative | Executive Director Hiroshi Yanagisawa |

| Address | Shinjuku Mitusi Building 43F, 2-1-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

| Asset Management Company | Canadian Solar Asset Management K.K. |

Overview of CSAM

| Corporate Name | Canadian Solar Asset Management K.K. |

|---|---|

| Address | Shinjuku Mitusi Building 43F, 2-1-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

| Business |

|

| Established | June 23, 2016 |

| Capital | 200 million yen |

| Shareholder Composition | Canadian Solar Projects K.K. 100% |

| Name of Representative | CEO&Represenative Director Hiroshi Yanagisawa |

| Registration, License, etc |

|

Portfolio List

Basic Philosophy

Cleaner Energy for the Next Generation

CSIF and CSAM aim to build a more sustainable economy and society through expansion of the use of renewable energy in Japan in line with their basic philosophy of “Aiming to advance the widespread adoption and use of renewable energy to build a more sustainable economy and society.”

Investment Highlights

1. The growth potential of the Investment Corporation, which is sponsored by developers of solar power generation facilities with extensive track records in Japan

- The Canadian Solar Group that operates globally

- A rich portfolio of sponsors, including a developer of large-scale solar power generation facilities

- Coordination with a vertical integration model, which covers the process from the manufacture of solar modules to the development and operation of solar power generation facilities

2. Taking advantage of a high level of sponsor management capability in pursuing the growth of the Investment Corporation

- Introduction of high-quality solar modules manufactured by the Canadian Solar Group

- Taking advantage of expertise in the planning and development of solar power generation facilities that was cultivated in the global market

- Use of O&M services to reduce operational risk and operational cost

3. Stable cash flow based on feed-in tariff (FIT), robust financial strategy and reasonable distribution policy

- Stable cash flow that takes advantage of FIT, etc. based on Japan’s medium- and long-term energy policy

- Growth strategy and reasonable distribution policy based on robust financial strategy and with a focus on reinvesting the amount equivalent to depreciation

Structure

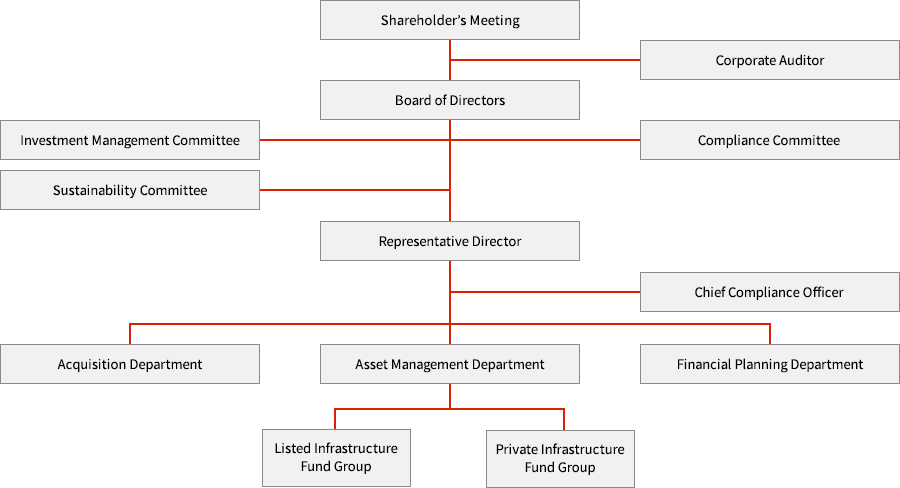

Organizational Chart of Asset Manager