Environmental Climate Change

Basic Approach

CSIF and CSAM, together with Canadian Solar Projects K.K., a sponsor for CSIF and CSAM, aim to contribute to building a sustainable economic society in local regions while paying attention to the global environment and therefore invest mainly in renewable energy power generation facilities and conduct business with a focus on the environmental aspect among ESG considerations.

■ Disclosure of information about climate change initiatives based on the TCFD Recommendations

Recognizing that climate change is an important environmental issue with potential risks and opportunities for business operations, CSIF and CSAM have decided to disclose information in line with the TCFD recommendations in the areas of governance, strategy, risk management, and metrics and targets.

(*)TCFD: Task Force on Climate-related Financial Disclosures Task Force on Climate-related Disclosures: Initiative which was established by the Financial Stability Board (FSB) based on the wishes of G20 Finance Ministers and Central Bank Governors and which recommended that organizations assess and disclose the potential financial impacts of climaterelated risks and opportunities.

Governance

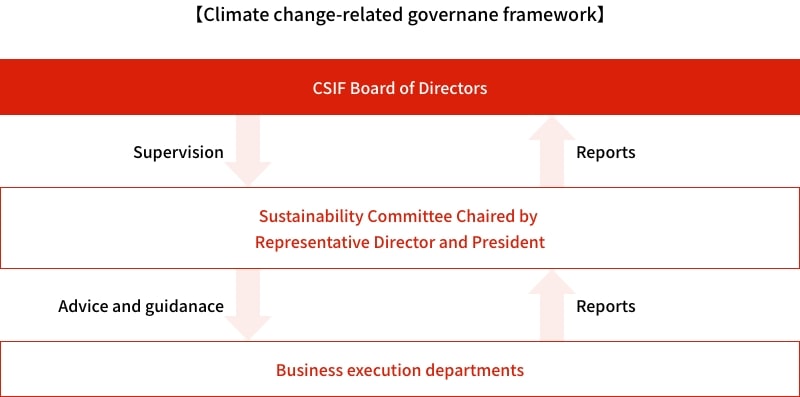

CSIF’s Board of Directors supervises action on ESG issues including action on climate change by receiving reports twice a year from the Sustainability Committee.

The Sustainability Committee is chaired by the Representative Director and CEO who is responsible for managing climate-related risks and opportunities.

Leveraging the latest knowledge of renewable energyrelated policy developments and climate-related disasters, etc., the committee identifies risks and opportunities based on the proposals of business execution departments and provides advice and guidance.

Risk Management

CSIF and CSAM evaluate the importance of solar power generation climate-related risks and opportunities, taking factors such as impact on business, probability of occurrence, connection with business strategies, and level of stakeholder interest into consideration.

The management process for climate-related risks is integrated into the Risk Management Regulations and Risk Management Policy established under the existing Risk Management Framework and identified material risks are managed from diverse perspectives including risk understanding and awareness methods, risk limits, risk mitigation measures (methods for addressing risk), and risk reduction methods on risk discovery.

Strategies

Identification of risks and opportunities

Risks and opportunities associated with climate change can be divided into “transition risks and opportunities” arising from the transition to a decarbonization society, such as the increased share of renewables in the electricity generation mix, and “physical risks and opportunities” arising from changes in the climate, such as the increased severity of climate-related disasters.

CSIF and CSAM recognize that these risks and opportunities will each materialize at different times and classified them into short, medium and long-term risks (0-5 years, 5-15 years and 15+ years) as shown in the table below.

this table can scroll to sideway

| Category | Key risks and opportunities | Materialization timing | |

|---|---|---|---|

| Transition risks | Regulations | Response to more rigorous assessment of environmental impacts | Short term |

| Decrease in volume of effectricity sales due to output curtailment | Short term | ||

| Market | Dcrease in electricity demand due to shrinking population | Long term | |

| Decrease in electricity demand due to decline of primary material industry | Long term | ||

| Technology | Contraction of commercial market due to expansion of residential market resulting from widespread introduction of distributed enerdy systems | Medium term | |

| Physical Risks | Acute | Rising cost of tracking natural disasters due to increased severity of climate-related disasters | Short term |

| Chronic | Decrease in volume of electricity sales due to changing weather patterns | Short term | |

| Opportunities | Products and Services | Increase in volume og electricity sales as a result of growing demand for renewables | Medium term |

| Market | Increase in volume of electricity sales due to wider range of facilities including floating solar power generation systems and farming type photovoltaic generation systems | Medium term | |

| Growth in electricity demand due to use of electricity in energy-intensive industries, etc. | Medium term | ||

| Technology | Decrease in capital expenditure due to increase in cumulative production volume of solar power generation facilities | Medium term | |

Scenario analysis

For climate change related risks and opportunities that we identified and organized, we conducted scenario analysis on the following themes which were assessed as having a “high degree of importance,” taking into consideration factors such as impact on business, connection with business strategies, and level of stakeholder interest.

- Impact of increasing severity of climate-related disasters on power plants (flood, high tide, wind damage)

- Increase in volume of electricity sales as a result of growing demand for renewables

- Increase in volume of electricity sales due to wider range of facilities including floating solar power generation systems and farming type photovoltaic generation systems

- Decrease in capital expenditure due to increase in cumulative production volume of solar power generation facilities

Metrics and Targets

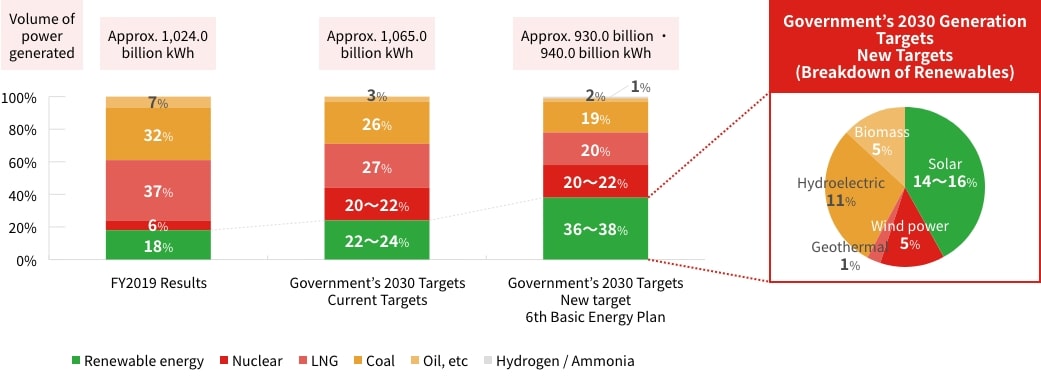

CSIF and CSAM recognize that government decarbonization and energy policy measures are important for investment in and operation of solar power generation facilities, which are their core business. The 6th Basic Energy Plan identifies renewable energy as a major power source and plans to increase the national target for renewable energy in Japan’s power mix to between 36% to 38% by 2030. This is double the FY2019 share (18%). Solar power is expected to be the largest renewable energy source, accounting for a 14-16% share of Japan’s power mix.

Using changes in the solar power share of Japan’s power mix as an indicator for managing future investment policy and risks and opportunities, we will contribute to the creation of a sustainable economy and society.

We also recognize that reduction of electricity sales loss through output curtailment is also important to ensure stable revenue from sales of electricity from solar facilities. To this end, we have been installing online output curtailment systems and we will continue considering gradually shifting to online output curtailment based on an assessment of cost-effectiveness.

this table can scroll to sideway

| Time of introduction | Shifted power plants |

|---|---|

| By 8th fiscal period | CS Mashiki-machi Power Plant, CS Shibushi-shi Power Plant CS Minami Shimabara-shi Power Plant (East), CS Minami Shimabara-shi Power Plant (West) |

| By 9th fiscal period | The above three power plants and all power plants in the Kyushu power grid except CS Hiji-machi Dai-ni Power Plant |

| By 10th fiscal period | All power plants in the Kyushu power grid including CS Hiji-machi Dai-ni Power Plant |