Governance Corporate Governance

CSIF’s asset management structure

SIF entrusts the management of its assets entirely to CSAM as Asset Manager. CSAM manages CSIF’s assets in accordance with an asset management agreement executed with CSIF.

In addition to CSIF, CSAM has also begun providing asset management services for a private placement fund since January 2019.

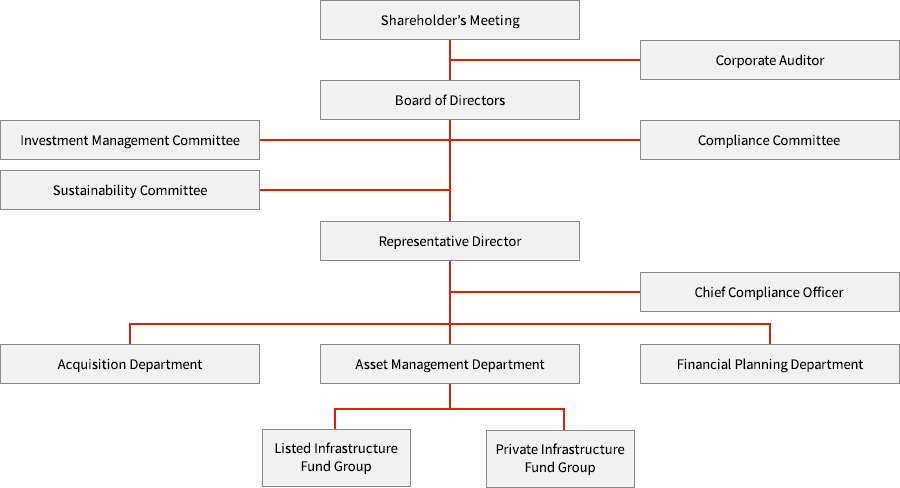

CSAM’s organization chart as of the date of this report is as follows.

this table can scroll to sideway

| Committee’s name | Outline | |

|---|---|---|

| Board of Directors |

|

|

| Members | All directors | |

| Frequency of meetings |

Ordinary meetings of the Board of Directors are held once every other month and extraordinary meetings are held whenever necessary. | |

| Investment Management Committee |

|

|

| Members |

Chair: Representative Director and CEO Members: All full-time Directors, the Chief Compliance Officer, all Executive Officers, all Department General Managers, and External Committee Members (Note 1)Part-time Directors may also attend meetings and make comments as observers but do not have voting rights. |

|

| Frequency of meetings |

In principle at least once every three months | |

| Compliance Committee |

|

|

| Members |

Chair: Chief Compliance Officer Members: Representative Director and CEO, all full-time Directors, all Executive Officers, all Department General Managers and External Members(Note 2) |

|

| Frequency of meetings |

In principle at least once every three months | |

| Sustainability Committee |

|

|

| Members |

Chaired by Representative Director and CEO Members: All full-time Directors, the Chief Compliance Officer, all Executive Officers and all Department General Managers |

|

| Frequency of meetings |

In principle at least once every six months | |

(Note 1)As of the date of this report, one real estate appraiser who does not have any special interest in CSIF or CSAM has been appointed as an externally recruited member.

(Note 2)As of the date of this report, one lawyer who does not have any special interest in CSIF or CSAM has been appointed as an externally recruited member.

CSIF’s Board of Directors

3 Directors (1 Executive Director and 2 Supervisory Directors)

Percentage of women directors: 33%

In selecting candidates for director, appointments are made based on the following election ground, through a resolution of the General Meeting of Unitholders, on the assumption that they do not fall under any of the grounds for disqualification set forth in various laws and regulations including the Investment Trust Act (Articles 98 and 100 of the Investment Trust Act, Article 244 of the Ordinance for Enforcement of the Investment Trust Act).

Selection criteria for Directors

this table can scroll to sideway

| Job title | Name | Reason for appointment as Director | Attendance at meetings of Board of Directors | |

|---|---|---|---|---|

| Fiscal period ended June 2022 |

Fiscal period ended December 2022 |

|||

| Executive Director |

Hiroshi Yanagisawa | Hiroshi Yanagisawa was appointed Executive Director based on the judgment that he has detailed knowledge of operations relating to the management of CSIF’s assets gained as Representative Director of CSAM, with which CSIF has concluded an Asset Management Agreement, and that he has sufficient knowledge and experience to carry out his duties as a member of CSIF’s Board of Directors. | 3/3 (100%) |

4/4 (100%) |

| Supervisory Director |

Takashi Handa | Takashi Handa was appointed Supervisory Director based on the judgment that he has detailed knowledge of accounting and tax affairs gained as a CPA and experience of auditing the accounts and managing the assets of listed companies and that he has sufficient knowledge and experience to supervise execution of duties by the Executive Director as CSIF’s Supervisory Director and to carry out his duties as a member of CSIF’s Board of Directors. | 3/3 (100%) |

3/4 (75%) |

| Supervisory Director |

Eriko Ishii | Eriko Ishii was appointed Supervisory Director based on the judgment that she has detailed knowledge of asset management-related the laws and regulations gained as a lawyer and that she has sufficient knowledge and experience to supervise execution of duties by the Executive Director as CSIF’s Supervisory Director and to carry out her duties as a member of CSIF’s Board of Directors. | 3/3 (100%) |

4/4 (100%) |

Remuneration for Directors

Remuneration for each Executive Director shall be an amount not exceeding 500,000 yen per month determined by the Board of Directors in light of factors such as the general price trend and wage trend and shall be paid monthly in arrears on the last day of the month.

this table can scroll to sideway

| Job title | Name | Total annual amount of remuneration paid to each Director |

|---|---|---|

| Executive Director |

Hiroshi Yanagisawa | 0 thousand yen |

| Supervisory Director |

Takashi Handa | 2,400 thousand yen |

| Supervisory Director |

Eriko Ishii | 2,400 thousand yen |

Accounting auditor’s fee

The accounting auditor’s fee shall be an amount determined by the Board of Directors up to a maximum of 15 million yen for each audited fiscal period, and such amount shall be paid by transfer to the accounting auditor’s designated bank account no later than three months from such fiscal period end.

this table can scroll to sideway

| Name | Details of fee | Total amount of fee |

|---|---|---|

| Grant Thornton Taiyo LLC | Fees for audit services (including English language audit)) | 11,000 thousand yen |

CSAM’s asset management fee structure

CSIF adopts investment trust management fees linked with revenues from the leasing business in connection with the assets under management in the business period concerned (“Asset Management Fees I”) and investment trust management fees linked with the sum of net income for the business period concerned and fixed adjustments (“Asset Management Fees II”). By integrating these investment trust management fees, CSIF intends to give CSAM an incentive to increase both the revenues from the leasing business and net income.

this table can scroll to sideway

| Asset Management Fees I | The amount of rents that arise from assets under management, incidental revenues, damages, penalties for the cancellation of lease contracts, money similar to such penalties and revenues from other types of leasing businesses x 6.0% (upper limit) Asset Managemen |

|---|---|

| Asset Management Fees II | The sum of Investment Trust Management Fees II, net income before the deduction of the consumption tax and the like on Investment Trust Management Fees II unqualified for deduction, and depreciation and amortization x 6.0% (upper limit) |

| Acquisition fees | Acquisition value x 2.0% (upper limit) Acquisition value x 1.0% (upper limit) in cases where the other party is a group of sponsors |

| Disposition fees | Transfer value x 2.0% (upper limit) Transfer value x 1.0% (upper limit) in cases where the other party is a group of sponsors |

| Merger fees | The appraisal value of the underlying assets which meant renewable energy power generation facilities and/or Real Estate related assets held by the subject investment corporation as of the effective date of the merger x 1.0% (upper limit) |

Unification of interests of sponsors with those of Unitholders

CSIF seeks to enhance unitholder value by aligning the interests of sponsors with those of unitholders.

Number of units held by sponsors and

their holding ratios

56,620(14.64%)

As of December 31, 2022

Fiduciary Duty

The Comprehensive Guidelines for Supervision of Financial Instruments Business Operators established by the Financial Services Agency describe the fiduciary duty required of investment management business operators in the following sections related to the supervision of investment management business operators.

VI-2 Appropriateness of Business Operations (Investment Management Business)

VI-2-1 Control Environment for Legal Compliance

Financial instruments business operators, which play an important role in investors’ investment management, have fiduciary duty to the investors who entrust investment to them, and are required to fulfill the duty of loyalty, the duty of due care, and the responsibility for ensuring segregated management under the FIEA. In addition, they are required to conduct their business operations as market players in a sound and appropriate manner.

The above duty is a duty imposed on an asset management company which assumes a duty of loyalty and a duty of due care to investors who entrust their investment to it under an Asset Management Agreement, and an asset management company is required to make judgments which do not harm the interests of the investors which have entrusted asset management to it when making various judgments about events which might give rise to a conflict of interests with the unitholders of the asset management company itself.

Accordingly, in the asset management decision-making process, especially in the case of conflict of interest transactions, checks need to be carried out from various perspectives and it is extremely important that systems are in place to prevent a breach of the imposed duties.

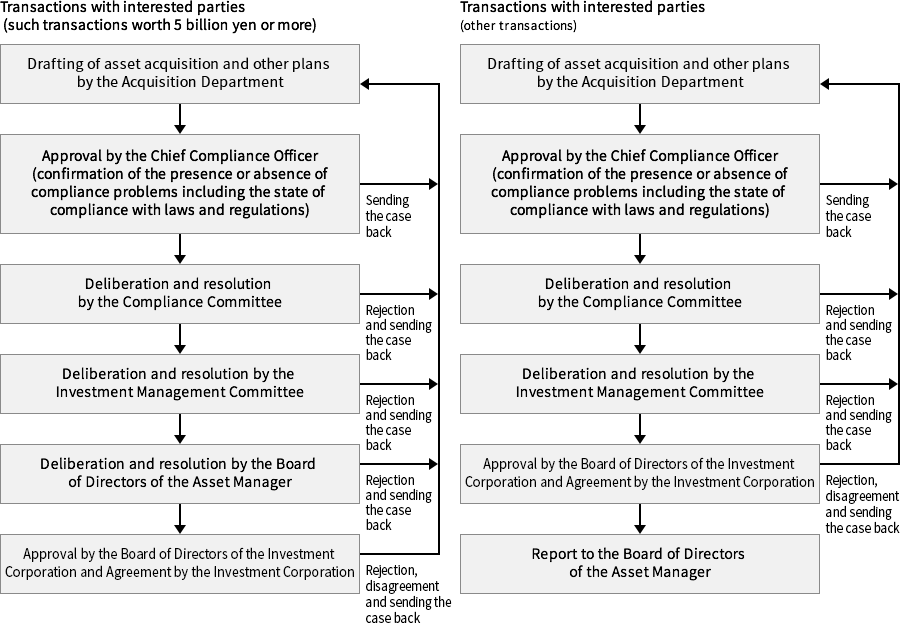

Measures against conflicts of interests

The Asset Manager has laid down measures for preventing harmful influences in the Regulations for Interested Party Transactions in connection with transactions and the like with interested parties such as Canadian Solar Group companies with which conflicts of interest are highly likely to emerge.